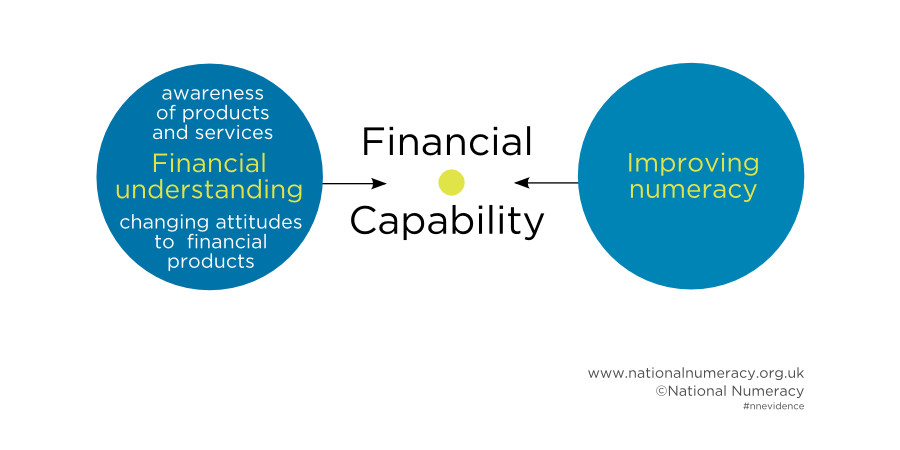

Evidence shows that numeracy is a major factor influencing people’s financial capability (Banks & Oldfield, 2007; Lusardi, 2012). Research indicates that low numeracy skills affect people’s abilities to select the cheapest loans, choose the most appropriate savings and insurance products, and make an effective budget (Carpena et al., 2011).

However, experts in the field suggest that there is not enough focus on the numeracy skills needed to improve people’s financial capability (Lusardi, 2012; The Financial Capability Strategy, 2014). The World Bank are strongly concerned about the current teaching on financial capability and suggest that:

“a financial education program that does not specifically address numeracy has little impact on an individual's ability to make financial calculations." (Carpena et al., 2011)

It is therefore essential that numeracy skills are taken seriously in work to improve financial capability in the UK.

Poor financial capability can also lead to problems with debt and mental health. There is strong evidence of a relationship between debt and mental health. Research suggests that people in debt are over three times more likely to have a diagnosed mental health disorder, over four times more likely to have a psychotic disorder, and almost eight times more likely to commit suicide (Richardson et al., 2013).

This evidence is confirmed by reports from the Citizens’ Advice Bureau (CAB) (CAB, 2014), who state that 73% of people seeking debt advice say that being in debt affects their mental health. Improving numeracy focused on financial capability is therefore also essential for improving debt-related mental health problems (Caron et al., 2007)

References

Banks J, Oldfield Z. 2007. Understanding Pensions: Cognitive function, numerical ability, and retirement saving. Fiscal Studies. 28(2): 143-170.

Caron J, Latimer E, Tousignant M. 2007. Predictors of psychological distress in low-income populations of Montreal. Canadian Journal of Public Health. 98(1): S35-44.

Carpena, F, Cole, S, Shapiro, J and Bilal,Z. Unpacking the causal chain of financial literacy. The World Bank. September 2011. [pdf] [Accessed 06 February 2015].

Citizens’ Advice Bureau. 2014. Money worries have impact on physical and mental health. 28th April. [webpage] [Accessed 09 January 2015].

Lusardi A. 2012. Numeracy, Financial Literacy, and Financial Decision-making. Numeracy. 5(1): Art 2. [ONLINE] [Accessed 06 February 2015].

Richardson T, Elliott P, Roberts R. 2013. The relationship between personal unsecured debt and mental and physical health: a systematic review and meta-analysis. Clinical Psychology Review. 33(8): 1148-1162.

The Financial Capability Strategy. 2014. The Financial Capability Strategy for the UK: The Draft Strategy. [pdf] [Accessed 06 February 2014].