This year, the theme for Number Confidence Week is 'Money Matters'

Over the years, we've heard from learners whose improved numeracy has transformed the way they manage their money. See what they had to say below:

Your Stories

10 Sep 2025

When it comes to managing finances, numeracy is an essential skill. Confidence with numbers helps us deal with budgeting, bills, payslips, bank statements, interest rates and much more. Yet many adults struggle with numeracy, which can affect their ability to manage money effectively.

Building confidence with numbers and money matters is best taught early – but it's never too late to learn. The ongoing cost-of-living crisis has also highlighted the need for number skills, with bills rising and budgets stretched further than ever.

Over the years, we've heard from learners whose improved numeracy has transformed the way they manage their money. See what they had to say below:

"Everything is a lot more organised and I feel things are 100% more manageable now… It's being in control of your own expenses and money and knowing exactly where everything is. Money is numbers."

![[field.image-text]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Ionut-opaque.png?itok=kfpLMy4l)

"Before I would've avoided that, but I was able to work out the exact impact. It made it real."

![[field.image-text1]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Jo-1-opaque.png?itok=pwl_8bca)

"I’m in my mid-40s, I'm a mother of four – do I really want to go back to college? They're paying me so much less than I could be getting. So I thought, why not?!"

![[field.image-text2]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Shajna-opaque.png?itok=jyUtrw7j)

"I feel a lot more confident about adding things up… knowing whether something is a bargain or not. I never would have been able to do that before."

![[field.image-text]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Jo-2-opaque.png?itok=CYfo-mHr)

"I use numeracy to manage money, calculate my income and understand my payslip. My new confidence with numbers has been very useful in applying it to daily life tasks."

![[field.image-text1]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Alma-opaque.png?itok=NLilhB9N)

"Maths is all around us. Being more aware of percentages now, I've been able to look at offers when shopping such as a tag that says '25% off'."

![[field.image-text2]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Rebecca-opaque.png?itok=GcyAd2bW)

"As a younger adult I used to open and close my bills and put them in a drawer because it overwhelmed me. It's so important to be comfortable enough with numbers that you can be on top of your finances and your life."

![[field.image-text]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Belinda-opaque.png?itok=5pIiAzPf)

"I'm working out what I've got, projecting what I'll need, and reconciling my bank account with what I'm spending."

![[field.image-text1]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Peter-opaque.png?itok=T7Nowwek)

"Before, I would have avoided a lot of things to do with maths, but now I'm much more proactive."

![[field.image-text2]](/sites/default/files/styles/scale_and_crop_600x350/public/images/Anne-opaque.png?itok=--ucgT_j)

This November, join our celebrity ambassadors, schools and organisations across the UK for Number Confidence Week: Money Matters, and take the first steps towards building confidence with numbers.

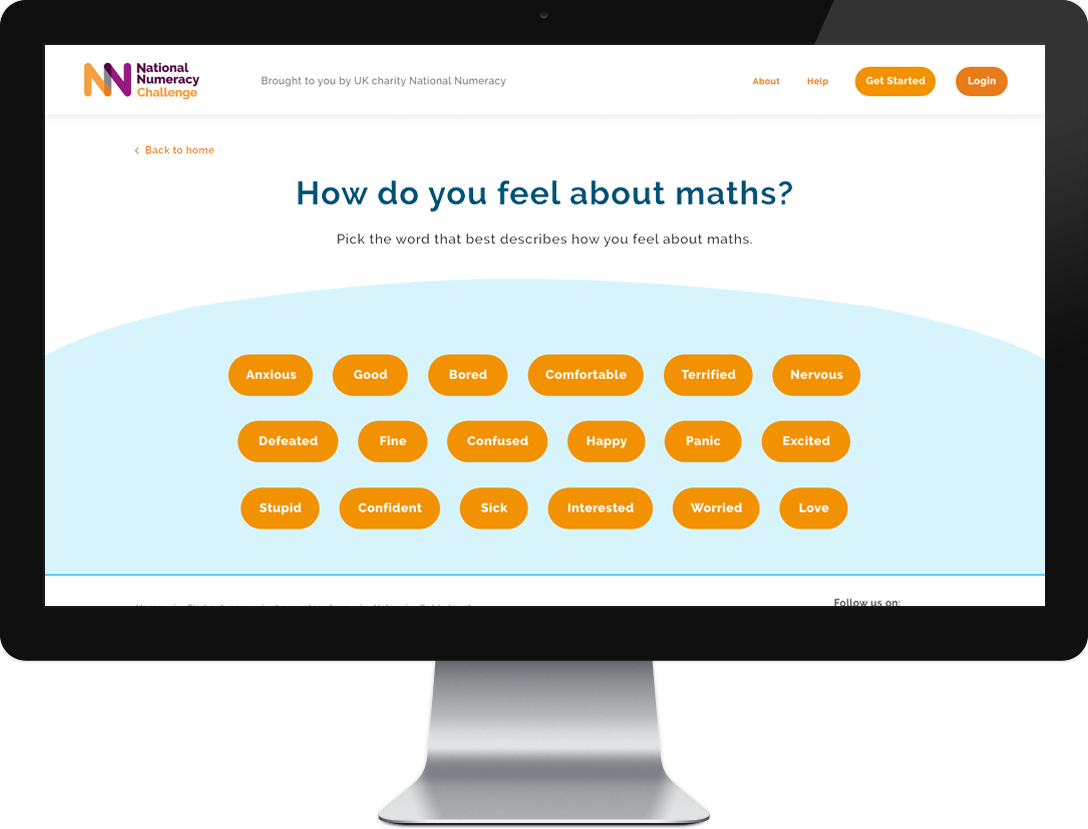

However you feel about maths, you’re not alone. The National Numeracy Challenge is a free and easy-to-use website you can use to improve your confidence with numbers, in your own time and at your own pace.

It’s ideal for brushing up, checking your level, or for catching up on learning you missed, and it’s all about the maths you need in daily life and at work – no algebra or trigonometry.