That’s why, this UK Savings Week, we want to shine a light on the link between number confidence and saving. Because the truth is, you don’t have to be a maths whizz to save. Small steps, regular habits, and a little confidence with numbers can go a long way.

The numbers barrier

It’s easy to think that managing money requires complicated calculations or expert knowledge. But everyday saving often comes down to simple sums:

- Keeping an eye on what’s coming in and going out

- Working out how much you can set aside each week or month

- Comparing prices to find the best deal

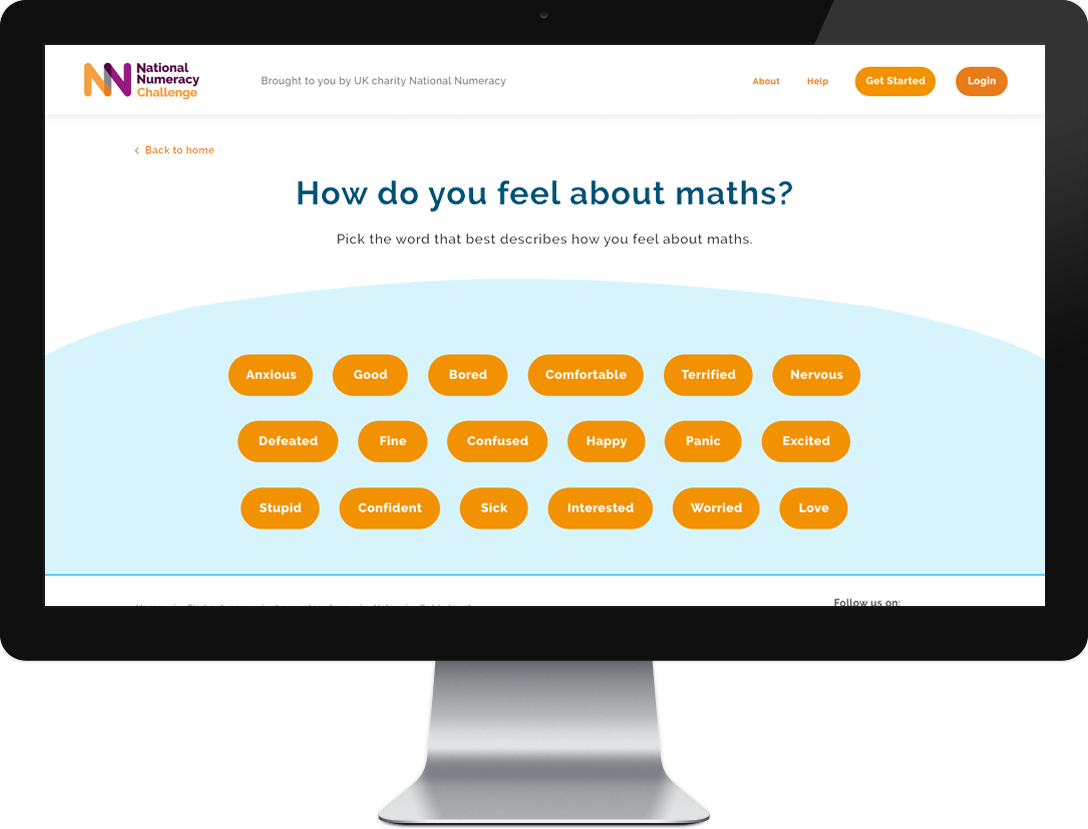

If numbers feel like a barrier, these tasks can seem daunting. And that can stop people from even starting. But the good news is: building number confidence doesn’t mean learning pages of equations. It’s about feeling comfortable with the everyday numbers that matter to you.

Start small, save small

The most powerful thing about saving is that you don’t need to begin with large amounts. Even putting away £1, £5, or £10 regularly makes a difference. Over time, those small amounts add up. Just as importantly, seeing your savings grow – no matter how slowly – builds confidence and motivation to keep going.

Think of saving as practice with numbers. Each time you set aside a bit, you’re not just building a financial cushion – you’re proving to yourself that you can handle the numbers. That positive cycle helps both your money – and your confidence – grow.

Everyday number confidence

So, how do you boost your number confidence to make saving easier? Here are a few simple steps: